Blockchain Smart Contract Potentials To Substitute Securities Trade Aspects

By Othman

Darwish

Introduction

This is a proposed solution to fully automated stock exchange market based on Ethereum blockchain innovated technology using smart contract and distributed

ledger technology DLT. Smart contract is a computer program that performs as

digital asset and is able to substitute today securities financial instruments.

Ethereum is an open source decentralized

computing platform that runs Smart

Contract. Blockchain is a database of a distributed ledger that hold digital

assets information (aka Smart Contract). By using Ethereum

network, all middlemen are removed and users ( issuers and investors) are

allowed to interact with each other directly. This solution will reduce time,

cost and operational risks, it will also automat censorship, and more importantly,

insure transparency and trust between all the parties involved in the

interaction of that network.

The ability of digitizing

financial assets to secure, trustworthy and programmable form is valuable since

it opens opportunities towards improving the financial services processes and

businesses.

Executive Summary

Smart Contract is one of the most exciting topic of

blockchain and distributed ledger technology at the moment, they have the

potential to radically change the way we conduct businesses. Smart contract is

a computer program that control digital asset, it can facilitate the automatic

payment of dividends, stock splits and liability management, also it reduces

counterparties and operational risks. Smart Contract aims to digitizing existing asset; when asset is

digital, financial services become software, and here is the value and innovation

behind this technology. Financial services are one of the last industries that

is going to be truly transformed into software; we've seen this happened to

music, publishing, telecommunication, and finally, the cryptography

breakthrough is at the heart of the financial services, which means that

security trade will become a program .

In nutshell , the security trade workflow started when the investor

wants to buy securities from the market place, the order is placed into Exchange

via an intermediary, this intermediary is called a broker. The broker is a special

entity that is authorized by the Exchange to buy securities on behalf of others and on behalf of itself, and there are

strict requirements to become a broker

and there are sets of compliances to make sure that a broker is performing a

good role on behalf of the investors. Once the order

is placed into the market via a broker,

the Exchange receives a buy order. Similarly

the Exchange receives a sell order into the same manner. Throughout the day,

the Exchange will be holding lists of buy and sell of different quantities of

securities at different target prices, The Exchange attempts to perform automatic matching based on price,

product, quantity and so on, when it finds a match, it will send back an order

confirmation of the details back to the broker, and the broker in turn will

forward those details to the investor. This process is termed as trade execution cycle process.After the Exchange confirmed the trade, it works hand in hand

with the clearing house. A clearing house is a special institution that is introduced

in the settlement cycle to safely guard the interest of the buyer and seller,

it effectively guarantees the trade on behalf of them. The clearing house

becomes materially important for much larger quantities of trades, where

billions and billions of dollars are being exchanged, here the clearing house

takes the owner ship of the trade and splits it into two separate trade legs; one leg is for the buyer to the seller, and the other leg is for seller to the buyer.

Doing so, it legally transfers the title of that shares for that period of time,

this is purely to become guarantor

for the safety of the investors.

Throughout the

trading day, there are numbers of trades that are coming through from

the Exchange, and the clearing house is responsible for performing netting . A

netting is a number of trades with same counterparty, and for the same product, trades can be

grouped together and netted into single transaction rather than multiple. At

the end of the day, the clearing house will create one net figure for the

settlement obligations of that counterparty and send through the counterparties

nominated custodian or nostro agent. At this point in time, the investor will

have a locked trade, in other words, the trade is being matched and confirmed

on the Exchange waiting for settlement. In U.S. , settlement normally needs T + 3, while in European standard it is T +2

, so two to three days are required to

pay for the securities.

Other intermediaries involved in trade cycle are the

registers (or stock transfer agents), they work on behalf of a company and are responsible

for maintaining a register of shareholders and keeping it up to date, if the

company is going to pay dividends, those registers are responsible for the

dividends distribution. The intermediaries also include the central securities

depository (CSD). CSD is a financial organization that acts as custodian of

custodians that hold securities, so that the ownership can be easily

transferred through book entry rather than the transfer of the physical

certificate, this allows brokers and financial companies to hold their

securities at one location so that they can be available for clearing and settlement.

Blcokchain technology is fundamentally influencing the way

that our economy, financial ecosystems

and businesses is functioning, and able to change our concept of trade

ownership and trust. This technology already exists and it is called cryptocurrency.

People think of Bitcoins as it is only a

virtual money or a transactions system; however, when somebody looks closer to

the blockchain or the distributed ledger (as some economists name it ) which is

the technology behind the Bitcoin payment network, you will see that some monetary aspects and processes could be substituted by this breakthrough innovated technology.Traditionally, securities trades follow complex structure of

intermediaries, trades are recorded in bookkeeping , we use third parties and

middlemen we trust to facilitate and

improve our transactions . In contrary, Blockchain distributed ledger can run

in a public/private network of computers

to maintain collective bookkeeping, this bookkeeper is a digital ledger which

is fully distributed across the network nodes, each node of the network owns a

full copy of the blockchain, the cryptography ensures that these nodes

automatically and continuously agree about the current state of the ledger for

every transaction in it. If anyone attempts to corrupts a transactions, the

nodes will not arrive to consensus and hence will refuse to incorporate the

transaction in the blockchain. In this way, every node has access to single

source of truth, this is why we can always trust the blockchain; Accordingly, relaying

on trusted custodian financial entities to transfer the ownership of asset is

questionable.Moreove, smart

contract which is a computer program that controls digital asset and runs

inside blockchain, it is able of documenting, transmitting and securing the

entire contractual relationships by issuer and investor, the smart contract can immediately transfer

asset into program, the program in turns - as legal contract - can run its code and evaluate its terms and

conditions, and accordengly, determine the ownership of the asset. By this, the

smart contract offers potential to streamline the whole trade cycle processes

by providing an end-to-end digitized

workflow between the buyer and seller, this is in near real time where t trade date

plus zero days ( T + 0 ) is required for

securities settlement, it also offers the ability to automate the payment of

dividends and enable more accurate proxy voting. Thus using a programmable

contract - as a legal and secure asset - will result in eliminating

counterparty and operational risk created by intermediaries. Thus, the complex

hierarchy of brokers , custodians, CSDs

and registers would collapse, or at least their functions and need will be

revised.On the other hand , smart contract could be used as a digital

identity to securely define the identity of the buyer or seller, it enables

individuals to own and control their digital identity that contain reputation,

data and digital assets. This allows individuals to choose what personal data to

disclose to counterparties, this gives

enterprises the opportunity to seamlessly know their customers, rather than

expensive and time consuming Know Your Customer (KYC) processes that lack

completeness.

The Proposed Solution

This proposal suggests a solution to automate securities

trade using Ethereum Smart Contract, it concentrates on how to apply this

technology to perform the exchanging of common

equities stocks instruments; for that a network that acts as a virtual permissioned private security market is built, with access

is limited only to the authorized members, so that those only can join and participate in this network. The

membership authorization process is out of this proposal scope.

The suggested solution is purely conceptual solution that's target

is to illustrate that this technology is able to automate securities trade

processes and cycles; thus, the financial market impact and legislation issues are out of this proposal scope.

For the members to interact with the network (the virtual

stock market), a special software is used to produce what we call the "Stock

Wallet". The Stock Wallet provides members the ability to interact with the network, and

perform various transactions operations on digital asset information stored in

the block chain. It acts as a computing node in the network which will mainly

participate in holding and verifying database information, this information is a full

copy of the ledger (aka blockchain) which is securely protected by the cryptography and synced with

all participating nodes in the network

at any point of time; in other words, whenever a user transact a Smart Contract (perform

transaction on his/her Wallet), the local blockchain copy of that Wallet is verified

and got updated, then marked as not

confirm transaction, the Wallet software then propagate that transaction for

all participating network nodes, at this point in time, all network nodes participate in

validating that transaction, if all

nodes agreed on that transaction (consensus), then the transaction become

confirmed one and added to immutable blockchain data block. The Wallet can be hosted

in an authorized businesses firms

computing machines or even on a permessioned users'

smart phones.

When a company issued a stock in primary market, it first

need to transform those stocks to digital asset of Smart Contract form, and

register them in blockchain database, this operation is called the Smart Contract

deployment. Once a Smart Contract is

deployed it will hold a set of properties; some of these properties have immutable nature (cannot be

altered during Smart Contract life time) such as, issuing company, stock name

and type; other properties could be adjusted as a result of transacting a Smart

Contract during its life time such as prices, owner, dividend rate...

Each Smart contract expose as set of stoke exchange services which could be executed (transacted) according to predefined service privilege,

for example the sell request service operation

could be executed only by stock owner, change ownership operation could be only

executed by the central bank, and get

price operation could be executed anonymously by any investor. Another powerful feature of Smart Contract is Events, events

could be fired by Smart Contract to announce a change on its state, concerned

parties (for example investors) could subscribe to those events and immediately

got notified whenever an event is fired, for example if an investor is

interested in stock of a specific type, he/she can subscribe to all Smart Contact

of that stock type, and thus we'll be notified about all sell requests along

with the proposed prices.

The bellow proposed tables summarize the Smart Contract

properties, operations and events. Table 1 lists properties along with their transacted

(modifiable) nature, those properties are updated as a result of executing

Smart Contract operations as listed in Table 2. Table 2 lists a set of

operations along with privileged parties allowed to execute them. Table 3 lists

a set of events which are going to be fired or trigged as a result of executing

Smart Contract operations, those events

could be subscribed by the interested parties in order to be notified

about the pending (waiting for an

action) transactions at their side.

Table 1: Smart

Contract (Stock) Properties

Property

|

Is transacted ( modifiable ?)

|

Issuing Company

|

No

|

Stock Name

|

No

|

Stock Type

|

No

|

Price

|

Yes

|

Dividend Rate

|

Yes

|

Dividend Yield

|

Yes

|

Owner

|

Yes

|

Table 2: Smart Contract (Stock) Operations

Operation (financial Service)

|

Privileged Party

|

Get Price

|

Investor

|

Buy Request

|

Investor

|

Buy Approval/Rejection

|

Buyer custodian bank

|

Sell Request

|

Owner

|

Sell Approval/Rejection

|

Owner

|

Change Owner Ship

|

Central Bank

|

Adjust Dividend Rate

|

Issuing Company

|

Adjust Dividend Yield

|

Issuing Company

|

Pay Dividend

|

Issuing Company

|

Start/End Voting

|

Issuing Company

|

Vote

|

Owner

|

Table 3: Smart Contract (stock) event

Event (notification)

|

Subscriber (consumed by)

|

Buy Request

|

Investor/Custodian bank

|

Sell Request

|

Investor/Custodian bank

|

Change Owner Ship

|

Buyer custodian bank to debit

it account

Seller custodian bank to

credit it account

|

Pay Dividend

|

Central bank to debit issuing company custodian bank and credit

Owner custodian bank settlement account .

Company custodian bank to debit company account.

Owner custodian bank to credit owner account.

|

Vote

|

Issuing Company to select board of directors

|

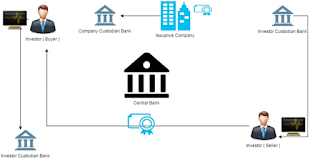

Effectively, securities

trade will be executed directly between the seller and buyer, custodian banks

will book-keep these trade transactions by debiting/crediting their customers, and

the central bank will perform near real time settlement and automate the

ownership transfer of the contracts.

Security Trade Exchange Scenarios

Execute buy operation scenario

The Investor in one of the scenario, using his wallet

application that runs on his computing

node (computer or smart phone), can monitor (through subscription) to "Sell

Request" events that are

executed in the network, the sell requests are displayed to him in an aggregated

form that summarizes sell stocks transactions

requests. The sell transactions requests include the stock quantities and

prices, and are grouped by companies stocks types ... Alternatively, in another

scenario, the investor can instantiate a "Buy Request" on the target

stocks along with proposed prices and quantities. These two scenarios are

elaborated by the next paragraphs.

Execute "Buy Request"

when supply of stocks is available

Here, the investor selects

quantities of stocks and create a "Buy Request", at this point in

time, all Smart Contracts of the corresponding stocks will be transacted by the

resulted buy requests, these requests will be logged as not confirmed

transactions, after that, the wallet application will propagate the resulted buy requests to all of

the participating nodes in the network, so that all of the receiving nodes will

participate in validating those requests, and if all of the nodes agree on

thier validity (aka consensus), the transactions will be accepted and become a

part of the immutable synchronized blockchain

block information data.

As a result of the above consensus on the validity

of the buy requests of the investor, the custodian bank of the investor (buyer)

will receive his customer buy requests, the bank in turn will perform the required

financial validation, and accordingly, he either accepts or rejects the

operation. Whatever was the bank action, it will be propagated to all network

nodes, verified and logged in the blockchain

database .

If the investor custodian bank

rejects the transactions (or some of them), the corresponding Smart contract

buy request status will be released allowing other investor to execute new buy

requests on them , such bank rejected requests could be a target for further auditing

operations.

If the investor bank accepts those

transactions, the central bank would be notified, so that he can perform any further

validations, and then, upon his approval, the following actions take place:

- · Transfer ownership operation for that contract, effectively the buyer will be the new owner of that contract.

- · Perform near real time settlement on the transaction counterparty (debiting the buyer custodian bank and crediting the seller custodian bank settlement account).

- Meanwhile, the seller custodian bank will be notified of the change in the ownership that is previously executed by central bank, and accordingly the seller custodian bank will credit the investor seller account and debit the buyer custodian bank by agreed on contract price value.

Execute "Buy

Request" when no supply of stocks is available

The buyer investor can instantiate

a "Buy Request" on target stocks along with proposed prices

and quantities, stock holder will receive these buy requests from the different

investors and they have the option to accept the requests of the most suitable

prices. When a seller investor approves a particular investor buy request, the workflow

continues in the same manner of the previously mentioned sequence of work; approving/rejecting

buyer custodian bank transactions, changing the ownership of the contract by the

central bank along with performing the settlement on the transaction counterparty bank, and finally notifying the seller custodian bank to debit the buyer bank and credit the seller

customer account.

Execute "Sell Request" Scenario

Sell operation can be

performed as a result of the buy operation requests as mentioned above, or it

can be instantiated separately (with no demand). The same activates would be

executed; from debiting/crediting buyer/seller at their custodian bank, debiting/crediting

counterparty settlement bank, and changing the ownership of the contract at

central bank .

Execute "Pay Dividend" Scenario

When a company declares dividends, it will execute "Pay

Dividend" operation on their issued contracts, as a result of this operation,

the central bank will be notified to perform settlement between the contract

issuing company custodian bank and contract owner custodian bank. In the same

way, the company custodian bank and the contract owner bank will be notified to

perform debit/credit bookkeeping entries

on the corresponding accounts.

Execute "Vote" Scenario

With Smart Contract, voting processes will be streamlined,

in a more effective and transparent manner. When the issuing company declares the start of

the voting, along with the nominated officers and board of directors OBDs, the

smart contract owner will have the ability to elect and make up the board of

directors.

Comments