Blockchain Smart Contract Potentials To Substitute Securities Trade Aspects

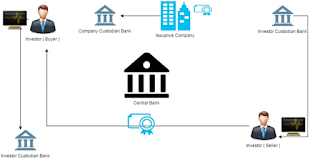

B y Othman Darwish Introduction This is a proposed solution to fully automated stock exchange market based on Ethereum blockchain innovated technology using smart contract and distributed ledger technology DLT. Smart contract is a computer program that performs as digital asset and is able to substitute today securities financial instruments. Ethereum is an open source decentralized computing platform that runs Smart Contract. Blockchain is a database of a distributed ledger that hold digital assets information (aka Smart Contract). By using Ethereum network, all middlemen are removed and users ( issuers and investors) are allowed to interact with each other directly. This solution will reduce time, cost and operational risks, it will also automat censorship, and more importantly, insure transparency and trust between all the parties involved in the interaction of that network. The ability of digitizing financial assets...